There were many stark differences between the two presidential candidates. Setting aside their personal demeanors, the Republicans and Democrats shared very little common ground concerning their vision for the Country. These differences could not have been more apparent than the issues of the economy, which included taxes, trade, and government regulation, to name a few. Today, Donald Trump will be sworn in for his second term, and all eyes will be focused on how quickly he will effectuate or abandon the economic policies he promised to fulfill. Trump’s proposed economic initiatives expressed during his 2024 presidential campaign have sparked discussions across several industries. For valuation professionals and attorneys who hire experts, these policies are critical to understanding how they could affect the economic landscape and the value of their client’s businesses. The potential impact of Trump’s platform and his ability to effectuate the relative changes must be understood by professionals representing business owners. Tax Policy Changes Corporate Tax Reductions Trump’s plan to reduce the corporate tax rate from 21% to 15% could directly increase the after-tax cash flows of many businesses, a primary driver of business value under the income approach. Capital-intensive industries, such as manufacturing, real estate, and energy, will benefit from a lower tax rate and higher net earnings. Example: A manufacturing company with pre-tax earnings of $5 million would save $300,000 annually under the lower tax rate. Assuming a 10% discount rate, this tax savings could increase the business’s valuation by approximately $3 million. Elimination of Certain […]

Blog

Category: Business Valuation

We have distilled decades of experience at the intersection of law, business and finance into a suite of articles to help our clients make sense of business valuation, forensic accounting, and litigation support. Please visit our site regularly for our latest content.

How Trump’s Economic Policies Could Impact Business Valuations

Posted in Business Valuation, on Jan 2025, By: Mark S. Gottlieb

ShareValuing a Business: The Market Approach and the Tale of the $6.5 Million Banana

Posted in Business Valuation, on Dec 2024, By: Mark S. Gottlieb

Share

In the world of business valuation, the market approach is akin to a treasure hunt, where comparable transactions are the clues leading us to the treasure trove of a company’s worth. However, just as in any good treasure hunt, not all clues are created equal, and sometimes, you might stumble upon a red herring. Take, for instance, the recent sale of a banana duct-taped to a wall for a staggering $6.5 million. Yes, you read that right—a single banana, a piece of duct tape, and a bare wall. The Market Approach: A Treasure Hunt The market approach relies on the principle of comparability. It’s the idea that you can estimate the value of a business based on the prices at which similar businesses have recently sold. This method is like using a map dotted with ‘X’ marks—each representing a comparable transaction. The key is to find enough ‘X’ marks to reveal a coherent picture. The $6.5 Million Banana: An Outlier or a Trend? So, what can the sale of a banana strapped to a wall tell us about business valuation? Imagine you’re on your treasure hunt, and you find an ‘X’ marked by a banana sale. Does this mean that every future fruit taped to a blank wall will be worth millions of dollars? Not necessarily. The banana sale, part of Maurizio Cattelan’s artwork titled “Comedian,” became an instant sensation, not for its fruitiness, but for its audacity and the statement it made in the art world. The value was […]

Beyond Financials: A Look at Key Valuation Drivers

Posted in Business Valuation, on Jul 2024, By: Mark S. Gottlieb

Share

Make no mistake about it: Analyzing and understanding the subject company’s financial statements is paramount when opining on value. However, when you start “peeling the onion,” other factors play an important role. This is why you can value two similar businesses simultaneously and arrive at different values. Key valuation drivers range from a business’s culture to tangible assets and/or intellectual property. The following provides just a few that should be considered beyond a company’s financial composition. Customers & Competitors Dependency on a few or limited customers will almost always make a business vulnerable. In other words, a diversified customer base is almost always preferable. A customer base extending across several geographic regions or market sectors may add even greater value than expected. This is not just a valuation expert speaking but a sentiment many sophisticated buyers share. Industry An industry by itself can also be a valuation driver – particularly if the sector is expanding rapidly, like AI. Business analysts are often attracted to startups in a young, hot industry – rather than one solely dependent upon organic growth. Keep in mind that you can’t use industry as your sole determinant of value. Value and the valuation process are acknowledged when a company distinguishes itself from the herd. Internal assets Favorable internal factors may also drive a company’s value. Although these factors may not be as clear as financial performance indicators, one should assess the following attributes when determining value: Management talent: Is the subject company’s management team capable of running […]

The Hunt for Hidden Cash in Closely-Held Businesses

Posted in Business Valuation, on May 2024, By: Mark S. Gottlieb

Share

Discussing hidden cash and unreported income is always a popular topic for both commercial litigators and family law attorneys. Currently, we are working on several engagements that have developed into full-fledged forensic accounting and fraud investigations. Experts (as well as IRS investigators) look at key areas to prove that cash is missing and to estimate how much income the business owner may not be reporting. Hidden cash can be discovered by taking a closer look at: Bank deposits: These can be used to reconstruct income by analyzing the parties’ bank deposits, canceled checks, and currency transactions, accounting for cash payments made from undeposited currency receipts and non-income cash sources, such as loans, gifts, inheritances, or insurance proceeds. Sources and use of funds: Here, the business owner’s personal sources and uses of cash are analyzed to determine where the owner’s income and other funds came from and how they were eventually used. If the owner is spending more money than they are taking in, the excess may represent unreported income. Net worth: An unsubstantiated increase in a business owner’s net worth can reveal unreported income. Telltale documents such as bank and brokerage statements, real estate records, and loan or credit card applications are often used to define this increase. The net worth gain is calculated, reported income is subtracted, and the amount is further adjusted to reflect any nondeductible expenditures and non-income sources of funds. Percentage markup: Net income is often estimated by applying a benchmark profit percentage to sales or […]

Shareholder-Level Discounts in Valuing Closely Held Companies

Posted in Business Valuation, on Apr 2024, By: Mark S. Gottlieb

Share

When valuing a closely held, private company, it is important to recognize that the process may be more complex than valuing a publicly traded one. While valuation experts apply discounts at both the entity and shareholder levels, this blog will focus on exploring the various types of shareholder-level discounts and their impact on the valuation of closely held companies. Shareholder-level discounts are applied specifically to the value of an individual shareholder’s interest, accounting for the unique risks and limitations associated with owning a specific ownership interest. These discounts are used in the valuation process to arrive at a more accurate representation of the fair market value of a shareholder’s interest. Discount for Lack of Marketability (DLOM) Selling shares and liquidating funds is not as simple for a private company as for a publicly traded company. In a public company, shareholders can typically sell their shares on a stock exchange and receive the proceeds within a few days. However, this is not the case for closely held companies, where selling shares can be lengthy and complex due to the lack of a readily available market. The discount for lack of marketability is one of the most frequently applied discounts in valuing closely held companies. This discount reflects the difficulty of selling or liquidating ownership interests in a private company compared to a publicly traded one. The DLOM is used to account for the limited liquidity of closely held company shares and the potential difficulty in finding a buyer. Additionally, legal and […]

How the Market Impacts Closely-Held Business Valuations

Posted in Business Valuation, on Mar 2024, By: Mark S. Gottlieb

Share

When valuing any business, one of the most important factors to consider is the overall market environment. After all, market conditions have an enormous influence on a company’s performance and what buyers are willing to pay. Privately owned businesses have more protection from immediate market fluctuations than publicly traded companies. But over the longer term, market forces always make their way into financial statements and operational health. In a strong, growing economy, valuations tend to be more generous when demand is high and access to capital is easy. Buyers have more confidence that a target business will continue thriving, allowing them to forecast future solid cash flows. This leads them to place higher multiples on a company’s earnings. Of course, the reverse is true in weaker, uncertain economies as well – buyers become more conservative in their projections, and valuations reflect that uncertainty. Market swings can impact industries and niches very differently, too. For example, a recession may completely deflate valuations of discretionary consumer businesses like gift shops when households pull back spending. As we saw during the result of the pandemic, demand for discount retailers and certain services may remain stable or even grow during downturns. Evaluating the market’s impact requires a nuanced, segment-by-segment analysis in addition to big-picture economic factors. An accurate business valuation must determine how the current market will likely affect future operations. As experts, we analyze historical performance, competitive forces, supplier costs, commodity prices, consumer demand, access to labor, and other external variables that impact […]

Scrutinizing The Capitalization Rate Within A Business Valuation Report

Posted in Business Valuation, on Feb 2024, By: Mark S. Gottlieb

Share

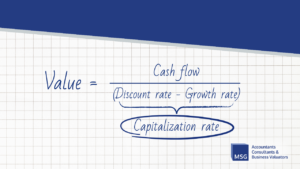

When representing a client with a business valuation report in hand, attorneys must look beyond the numbers at face value. Though you often leave the financial modeling and technical details to the valuation experts, a keen understanding of valuation inputs remains imperative for attorneys on either side of a transaction or dispute. The capitalization rate (a.k.a. the “cap rate”) is among the most impactful business valuation inputs. This factor warrants particular scrutiny, as variations of even 0.5 percent can alter the valuations significantly. Properly vetting this input is essential to achieve an accurate valuation that stands up to legal scrutiny. To add another instrument to your toolbelt, we will provide a quick primer on the cap rate and its components. What is the Capitalization Rate? The capitalization rate is the rate of return used to convert a business’s annual earnings or cash flows into an initial company value, accounting for risk and growth prospects. Computed as the difference between the discount and growth rates, the cap rate involves a nuanced evaluation of multiple factors. Attorneys should be familiar with these items to interpret their credibility quickly. Discount Rate The discount rate is the annual rate used to convert projected future cash flows into present value, reflecting the riskiness, time value of money, and required rate of return an investor would expect on the investment. The most common components used when computing the discount rate are: Risk-free rate of return Equity risk premium Size Premium, and Company-specific risk premium Generally, empirical […]

Detecting ‘Window Dressing’ Tactics in M&A Valuations

Posted in Business Valuation, on Jan 2024, By: Mark S. Gottlieb

Share

As a business valuation expert, I am often called in to assess the true value of a business that is the target of an acquisition. In many such deals, there’s an intricate dance between financial reality and manipulated appearances, which may present a glossier, more appealing image of a company’s financial health than what reality might reveal. In a recently reported case between two private equity firms, the acquirer alleged the seller employed multiple accounting gimmicks to inflate the earnings of a software company, Mobileum, prior to its $915 million sale. By prematurely booking revenues and masking expenses, they claim the target’s profits were artificially inflated by over $250 million. While the allegations remain in dispute, they underscore risks I regularly highlight to clients. As we evaluate the financials of an M&A target, here are some manipulative techniques that our team looks for. Premature Revenue Recognition Illegal yet common, this ploy involves recording future anticipated revenue as current-period income, inflating top-line figures before a sale. Sellers may book forward years of subscription revenue, excessive sales to partners, or less commonly, fictitious sales from shell companies to portray accelerated growth. Capitalizing Expenses This tactic converts regular operating expenses into long-term capital expenditures, enabling costs to be depreciated over years instead of impacting the income statement immediately. By reclassifying expenses as assets without proper documentation, companies reduce reported expenses, inflate reported assets, and subsequently increase profits and net worth. Channel Stuffing A risky tactic, channel stuffing involves shipping surplus products to distributors […]

How Lower Valuations Can Sweeten the Deal for Employees

Posted in Business Valuation, on Oct 2023, By: Mark S. Gottlieb

Share

Twitter, or “X”, taken private after Elon Musk’s $44 billion acquisition just over a year ago, is now valued at only $19 billion. A new internal memo is cited offering employees restricted stock units (RSUs) at a share price of $45. When private companies offer stock-like compensation options, the IRS advises them to use a 409A valuation – an independent assessment of how much a company is worth. These appraisals tend to be more conservative than valuations based on recent funding rounds or offers from potential acquirers, for example. X itself is “still negative cash flow,” Musk shared in July, citing a “50% drop in advertising revenue plus heavy debt load”. So, it’s not unsurprising that X’s 409A valuation came in lower than the $54.20 per share that Musk paid to take the company private. Because of this conservative approach, it’s common for companies’ 409A valuations to come in lower than their previous private market valuations. Last year, Stripe and Instacart saw their valuations slashed by 28% and 38%, respectively after new 409A appraisals. There are a few reasons why private companies incentivized by employee stock compensation may actually prefer to have lower 409A valuations: Lower strike prices on stock options give employees more potential upside and incentive to join and stay. With a lower valuation, the same number of shares granted or optioned to employees represents less dilution percentage-wise for existing shareholders. Companies can reduce stock-based compensation expenses with a lower 409A valuation. Employees only pay taxes when they […]

Plotting Your Client’s Financial Finish Line: Exits for Entrepreneurial Retirees

Posted in Business Valuation, on Oct 2023, By: Mark S. Gottlieb

Share

As the baby boomer generation continues to reach retirement age, with 10,000 individuals turning 65 every day, the United States is facing a “silver tsunami” of business owners looking to exit their companies. This mass exodus of entrepreneurial talent has made exit planning for retirees an increasingly pressing issue, especially for closely-held businesses. When advising clients on retirement and ownership transition, forensic accountants and business valuators provide invaluable expertise by highlighting crucial financial considerations that can profoundly impact the success of the process. In this blog post, we will explore five key points that business owners should keep top of mind when starting their exit plans. From stock options and business valuations to tax implications and ESOPs, our goal is to provide attorneys and their clients with the financial clarity needed to help navigate the choppy waters of retirement and ownership transition. Stock Options: Stock options are a cornerstone of exit planning. Clients must grasp the significance of these financial instruments, and this is where the expertise of forensic accountants and business valuators becomes crucial. These professionals can elucidate the nuances of restricted stock, stock appreciation rights, and employee stock ownership plans (ESOPs), shedding light on the potential advantages and disadvantages of each option, including intricate details such as control retention and tax implications. Business Valuation: The accuracy of business valuation is paramount in exit planning. Forensic accountants and business valuators possess the specialized skills required to determine the true value of a business. Their expertise in employing diverse valuation […]